Issue 11: A Briefing on the Business of Education and Creative Thinking

January 2026: Consolidation, Leadership Continuity, and Strategic Partnerships in Independent Education

The first half of January 2026 has seen continued consolidation and strategic repositioning across the independent education sector. 20 notable market events have been recorded since January 1. They are concentrated around senior leadership appointments, school partnerships, and targeted group acquisitions.

Appointments

Senior Schools

A series of high-profile headship appointments announced:

Felsted School has appointed Lara Péchard (St Margaret’s School, Bushey) from September 2026, succeeding Chris Townsend, who moves to Cheltenham College.

Ardingly College names Alastair Tighe, currently Head Master at Wells Cathedral School, effective September 2026. Outgoing Head Ben Figgis departs for Munich International School after more than a decade in post.

Prep School Leadership

Beeston Hall School appoints Dougal Lyon from Craigclowan School bringing over 16 years’ experience as part of ongoing development within the Radley Schools Group.

Orwell Park School names Alex McCullough, formerly of Polwhele House School and Perrott Hill, to support its partnership with Benenden School.

Perrott Hill School has appointed long-serving deputy Will Silk as Headteacher from April as the school enters its next phase under the Perrott Hill Education Group.

International and Group Appointments

GEMS Education appoints Ann Haydon MBE as Principal of GEMS Wellington Academy - Al Khail.

Affinitas Education names Gabby Rowe as CEO for the US and Canada, reflecting continued international growth ambitions.

Partnerships and Organisation Structures

January saw an acceleration in partnerships designed to strengthen prep-to-senior school routes:

Harrow School announced a strategic partnership with Lockers Park joining the wider Harrow group from Spring 2026 while retaining its brand and admissions independence.

Hurstpierpoint College confirmed a similar arrangement with Pennthorpe School.

St Albans School and Beechwood Park School established a 3–18 route with shared provision and preferential admissions, remaining independent entities.

These models point to further collaboration focused on sustainability rather than a full merger.

Research, Development, and International Strategy

St Paul’s School Group strengthened its research capacity with appointments to the St Paul’s Research Centre for the Education of Boys, reinforcing its commitment to evidence-informed practice.

Dragon School, Oxford appointed Tom Aubrey-Fletcher as Director of Dragon International to lead its international strategy.

International Schools Partnership (ISP) acquired American Academy Casablanca.

North London Collegiate School (Singapore) abandons planned S$160mn Harbour Drive site expansion following FT investigation into alleged safeguarding lapses and toxic culture, with property partner Meraki redirecting the site to another international school.

Pressures and Responses

Warminster School sells prep building and consolidates all pupils at Weymouth House from September 2026 to achieve long-term financial stability amid sector challenges.

Exeter Cathedral School announced the closure of its Prep division from September 2026 due to financial pressures. Inspired Learning Group acquired the Nursery and Pre-Prep, to continue as Hall House in collaboration with Shebbear College.

Curriculum and Delivery Innovation

King William’s College announced a blended Sixth Form route from September 2026 in partnership with King’s InterHigh, offering 22 A-level subjects alongside its IB Diploma Programme.

This reflects growing interest in hybrid delivery models to broaden subject access and manage cost pressures. Update to follow later this year.

Updated Activity Trends (2025–2026)

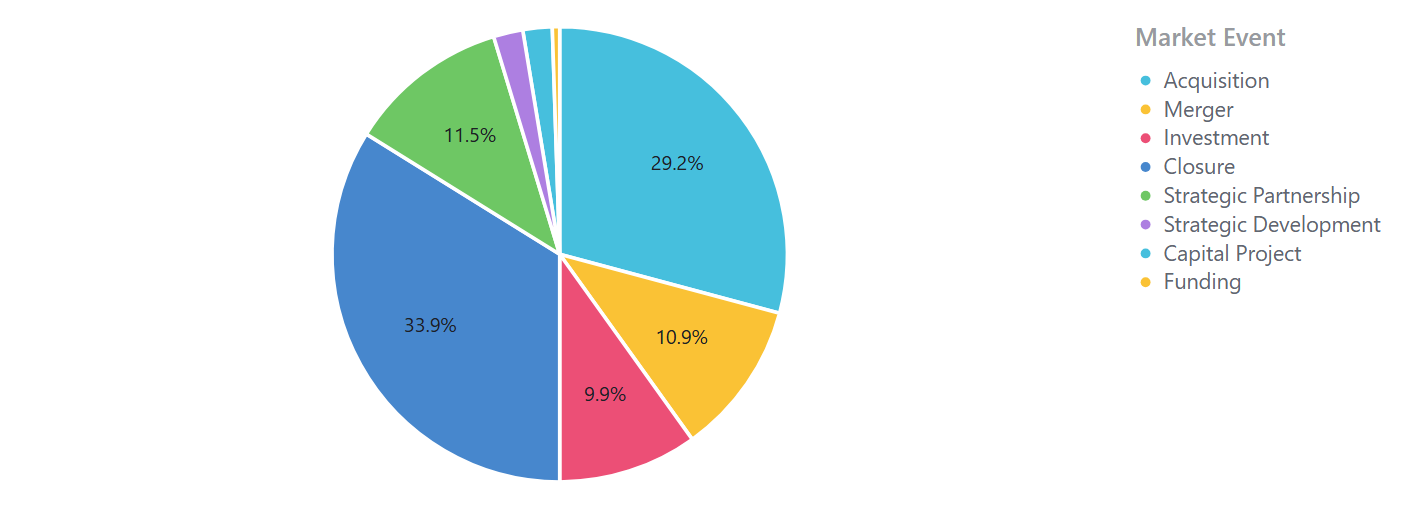

Analysis of tracked activity from 2025 reveals a tri pattern in the independent market landscape:

Closures: ~34%, reflecting complex pressures on certain organisations.

Acquisitions: ~30%, indicating strategic consolidation by larger education groups.

Investment activity: ~10%, highlighting cautious capital deployment.

Mergers and strategic partnerships: ~22%, reflecting a trend toward collaborative growth rather than outright mergers.

Forward View

Early January activity points to a sector focused on consolidation, leadership continuity, and structured collaboration. Domestically, schools are adopting strategies to protect market position, manage financial risk, and extend reach through partnerships, capital projects, and group structures. The internationalisation of leadership and the selective adoption of hybrid delivery models remain notable themes. These developments illustrate a sector adapting to a complex mix of economic, political, cultural, ideological, technological, and demographic pressures.

Personal Note

Thank you for reading this week’s longer than usual briefing. I hope you have had a good start to the term and happy New Year. I’m grateful for your messages and the insights many of you have shared.

Following some reflection, I plan to continue this series for the next five weeks, up to half term, sharing a weekly update on the developments and trends shaping the independent education sector in England and, where relevant, internationally.

If you come across relevant news, appointments, or activity worth including, please do share it. I’d love to feature contributions from subscribers to ensure this briefing reflects the breadth of what’s happening across the sector. You can use the form here. Every piece helps us build a more informed picture of the market.

Thank you again for your support and for reading. Please do forward it and share with colleagues.

Jonathan