Issue 10: A Briefing on the Business of Education and Creative Thinking

2025 Sector Overview: Key Movements, Market Events, and Three Draft Ideas for Strategic Adaptation.

Series Note

Closing this briefing series, this issue provides a 2025 sector overview and introduces three draft adaptation ideas for independent schools. It also highlights the Story Line exhibition and the launch of new digital archives from The History of Advertising Trust.

Executive Snapshot (2025)

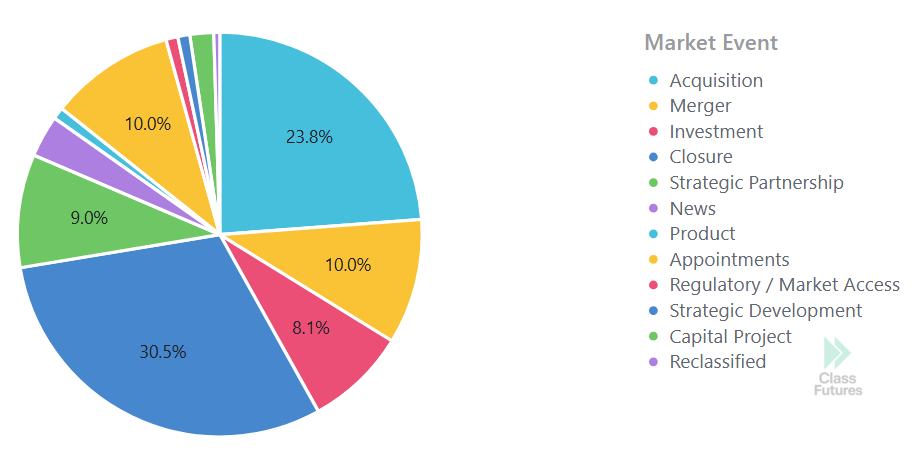

The UK independent education sector in 2025 was characterised by accelerated consolidation, strategic partnerships, and capital investment, alongside an unprecedented number of school closures. Expansion activity among well-capitalised groups contrasted sharply with mounting pressures on smaller standalone schools.

Market Structure and Ownership

Consolidation and Acquisitions

Multi-School Group Expansion

Radley Schools Group emerged as a major new consolidator, acquiring seven prep schools including Barfield, Cothill, Mowden Hall, Kitebrook, Beeston Hall, West Hill Park, and Chandlings.

Blenheim Schools Group / Outcomes First Group completed a high number of acquisitions, including Akeley Wood, Huddersfield Grammar, and Hydesville Tower School.

Inspired Learning Group continued expansion with acquisitions of Shrewsbury High School, Royal Hospital School, Derby Grammar, and Clayesmore.

Strategic Mergers and Expansion

St Paul’s School Group formed through the merger of St Paul’s Prep (formerly Junior), Durston House, and Shrewsbury House.

Mill Hill Education Group welcomed Heathfield School and Westbrook Hay; Roedean announced a proposed merger.

Westminster School confirmed full co-education alongside significant estate expansion.

International Growth

Middle East and Asia

Rugby School Dubai to open August 2026 in partnership with Aldar Education.

Bedford School Mohali launching April 2026 as India’s first British international girls’ school.

Brighton College announced three new European schools (Madrid, Rome, Lisbon) from 2027.

Malvern College establishing a Saudi Arabia campus by 2027.

Capital, Investment & EdTech

Partnerships and Strategic Investment

CVC took a 20% stake in International Schools Partnership at a valuation triple that of 2021.

GEDU Group announced a £200 million investment programme in India, positioning itself as the largest foreign education investor in the country.

Estate and Infrastructure Development

Westminster School estate modernisation, including Chapter House and Tufton Street acquisitions.

Bede’s School Lower School expansion for September 2027.

Magdalen College School secured Oxford City Council approval for a new Science, Library & Partnerships Building.

Repton Dubai opened a new Sports Village following extensive facilities investment.

Technology and EdTech Funding

MyEdSpace raised £11.15m in Series A funding.

Orbital Education secured an eight-figure HSBC funding package.

Creative Hut received first-time investment from Founders Private Capital.

RM plc reported FY25 adjusted operating profit of approximately £11.5m, up 34% year-on-year, driven by strong growth in its core Assessment division.

Market Exits and Pressure Points

School Closures

Closures in 2025 affected both large and small institutions, with notable regional clustering:

Large school closures included Mount St Mary’s College (329 pupils), Loughborough Amherst (410 pupils), and Our Lady’s Abingdon (368 pupils).

Prep school closures included Maidwell Hall (153 pupils) and Queen Margaret’s School (194 pupils).

Concentrations were most evident in London, the South East, and the East Midlands.

The third draft of the 2025 closures Google map is available to view here.

Leadership & Governance

Senior Appointments

Jeanette Cochrane appointed Chief Executive, Girls’ Schools Association.

Chris Staley named inaugural CEO, Loughborough Schools Foundation.

Andreas Tolpeit appointed interim CEO of Cognita following Frank Maassen’s departure.

Lucy Pearson became the first female Head in Oakham School’s 440-year history.

Matt Williams announced as incoming Head of Seaford College (September 2026), joining from Warminster School.

Jason Whiskerd has been appointed UK General Manager at Cognita Schools, working closely with school leaders and the UK leadership team

Market Outlook

The 2025 landscape illustrates divided market activity: well-funded groups pursuing scale, international reach, and capital investment, while smaller independent schools face sustained cost and demand pressures. Partnerships and strategies for adaptation are becoming increasingly central to resilience. Stewardship, anchored in a clear educational philosophy, remains key. Investment house operators risk neglecting the educational philosophy in both the short and long term.

Strategic Adaptation: Three Draft Ideas

1. Pricing and Cost Transparency

The Civitas-led Commission on the Future of Independent Schools in England reported average annual day fees of £18,600 (2023/24), with fees tripling in real terms between 1980 and 2016. What follows are three draft ideas emerging from 2025 discussions on sustainability and market positioning. Growth opportunities may lie in specialist and mid-market provision. Recent commentary also highlights the importance of understanding revenue per contact hour and the true cost of delivery.

2. Partnerships and Ecosystem Thinking

Sustainable models will require schools to look outward - engaging communities, developing partnerships, and building additional services. The Real Education Policy Forum, referencing Civitas’ Commission on the Future of Independent Schools in England, highlights recommendations for schools to form ‘anchor’ and/or ‘innovation’ hubs, coordinating services and introducing novel schooling approaches for the wider community. This could involve outreach initiatives, hybrid learning, and supporting home-school families.

3. Incentivise

Staff who design and deliver new products should be recognised and rewarded. Teachers’ special strengths in classroom management and facilitating learning can translate into new contexts, including AI training, language schools, hybrid learning models, and online enrichment.

Closing Note

There is no single solution and it is complex. Schools willing to reassess pricing, think more creatively about partnerships, and incentivise forward thinking individuals are better positioned for the next phase of change.

As this remains a work in progress, I’ve genuinely appreciated the thoughtful feedback, comments, and conversations this Class Futures briefing series has created. I’m always happy to receive emails via the About page and welcome ideas for one or two new projects in 2026. Thank you again for reading. If you’ve found this helpful, please forward it to colleagues or share it - it means a lot to me.

Looking ahead to 2026, I want to keep learning and understanding your challenges in independent education. Send me a connection on LinkedIn so we can form a stronger, collaborative community.

Jonathan

PLANNER / Dates For 2026

Independent Schools Leadership Forum 2026 - a one-day strategic forum for Heads, Governors and Bursars, bringing together RSAcademics, Grant Thornton UK and Withers to examine leadership, governance, finance and regulation shaping the independent sector. Look froward to expert panels, focused breakouts and a forward looking futures session. Tickets are from £120 and available to purchase here.

Bett 2026 - The world’s largest education technology event returns on 21-23 January, bringing together educators, policymakers, and industry leaders to explore the latest in digital learning and education through talks, showcases, and networking. Event details here.

ART / Paula Rego: Story Line

Pencil it in: Victoria Miro will present Story Line, the most comprehensive exhibition of Paula Rego’s drawings ever staged.

Spanning seven decades, it explores how Rego’s distinctive line shaped her storytelling. Expect rarely seen sketches, studies for major works, and intimate pieces from childhood to her final years.

Exhibition: 17 April–23 May 2026

Where: Victoria Miro, 16 Wharf Road, London N1 7R

More info: victoria-miro.com

ADVERTISING / New Digital Archives

The History of Advertising Trust is creating three new digital archives to honour the legacy of FCB, DDB, and MullenLowe, following their closure after Omnicom’s takeover of Interpublic Group in November. It’s on the look out for work and digital material linked to these iconic ad agency brands.

Here’s a thought: should we consider creating a History of Independent Education archive? A dedicated library for materials from retired and closed independent schools could uncover fascinating stories and resources - and it might even be housed at Buckingham University.

Here’s a thought: should we consider creating a History of Independent Education archive?

“When you write your story… invention comes when you do a drawing. As you are drawing something, it very often turns into something else, and you can go with it. It develops in a completely different way, it’s organic and it’s done with the hand. The hand makes it change and so on.”